Category: Solunar Model

Who to follow?

Central Banks vs. Cycles

Under Construction

Who’s On First?

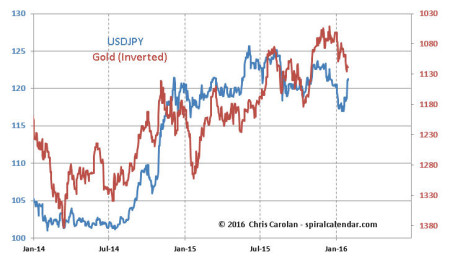

After seeing a few too many tweets stating that the oil market is leading this highly-correlated dance, I investigated last night’s sharp reversal and found it was dollar yen, not crude oil that set the trend.

click chart to enlarge

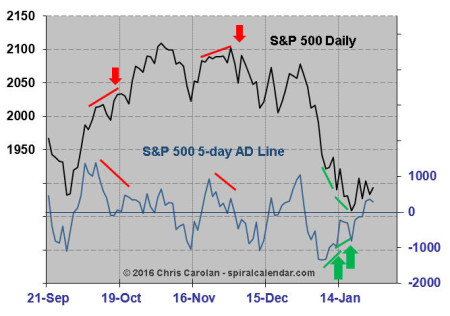

click chart to enlarge

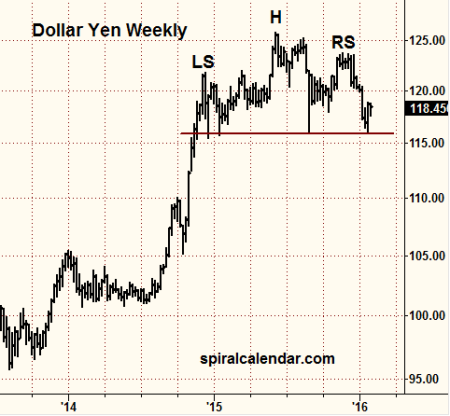

If world financial markets are depending on dollar yen now, we are in for some trouble, as the above long-term, as yet unconfirmed, head-and-shoulders formation on dollar yen shows.

click chart to enlarge

click chart to enlarge