All four markets with Solunar Models are following current seasonal direction; stocks up, gold down, oil down, rates up. I note that the Solunar Models have periods of effectiveness and periods of ineffectiveness. They are most effective when markets are

emotional.

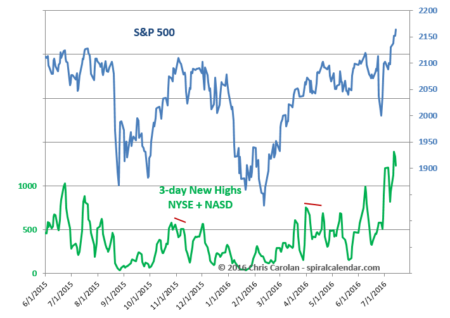

click chart to enlarge

Short term topping.

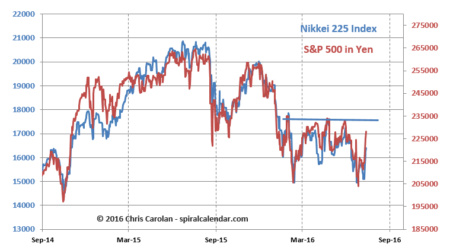

click chart to enlarge

Nikkei still lagging.

click chart to enlarge

In yen terms, S&P rally is move back into resistance.